Page 2 - InsideTax Edisi 17th (Per(soal)an Konsultan Pajak)

P. 2

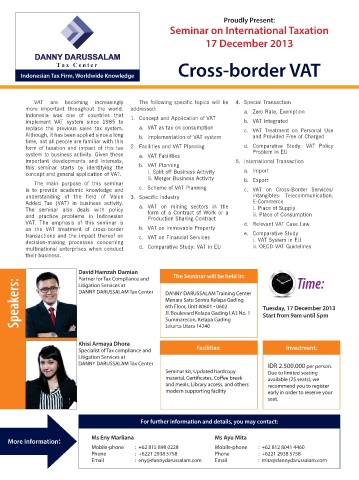

Proudly Present:

Seminar on International Taxation

17 December 2013

Cross-border VAT

Indonesian Tax Firm, Worldwide Knowledge

VAT are becoming increasingly The following specific topics will be 4. Special Transaction

more important throughout the world. addressed: a. Zero Rate, Exemption

Indonesia was one of countries that 1. Concept and Application of VAT

implement VAT system since 1985 to b. VAT Integrated

replace the previous sales tax system. a. VAT as tax on consumption c. VAT Treatment on Personal Use

Although, it has been applied since a long b. Implementation of VAT system and Provided Free of Charged

time, not all people are familiar with this

form of taxation and impact of this tax 2. Facilities and VAT Planning d. Comparative Study: VAT Policy

system to business activity. Given these a. VAT Facilities Problem in EU

important developments and interests, 5. International Transaction

this seminar starts by identifying the b. VAT Planning

concept and general application of VAT. i. Split off Business Activity a. Import

ii. Merger Business Activity b. Export

The main purpose of this seminar

is to provide academic knowledge and c. Scheme of VAT Planning c. VAT on Cross-Border Services/

understanding of the field of Value 3. Specific Industry Intangibles: Telecommunication,

Added Tax (VAT) in business activity. E-Commerce

The seminar also deals with policy a. VAT on mining sectors in the i. Place of Supply

form of a Contract of Work or a

and practice problems in Indonesian Production Sharing Contract ii. Place of Consumption

VAT. The emphasis of this seminar is d. Relevant VAT Case Law

on the VAT treatment of cross-border b. VAT on Immovable Property

transactions and the impact thereof on c. VAT on Financial Services e. Comparative Study

decision-making processes concerning i. VAT System in EU

multinational enterprises when conduct d. Comparative Study: VAT in EU ii. OECD VAT Guidelines

their business.

David Hamzah Damian The Seminar will be held in: Time:

Partner for Tax Compliance and

Speakers: DANNY DARUSSALAM Tax Center DANNY DARUSSALAM Training Center Tuesday, 17 December 2013

Litigation Services at

Menara Satu Sentra Kelapa Gading

6th Floor, Unit #0601 - 0602

Jl. Boulevard Kelapa Gading LA3 No. 1

Start from 9am until 5pm

Summarecon, Kelapa Gading

Khisi Armaya Dhora Jakarta Utara 14240

Specialist of Tax compliance and Facilities: Investment:

Litigation Services at

DANNY DARUSSALAM Tax Center

IDR 2.500.000 per person.

Seminar kit, Updated hardcopy Due to limited seating

material, Certificates, Coffee break available (25 seats), we

and meals, Library access, and others recommend you to register

modern supporting facility early in order to reserve your

seat.

For further information and details, you may contact:

Ms Eny Marliana Ms Ayu Mita

More Information:

Mobile-phone : +62 815 898 0228 Mobile-phone : +62 812 8041 4460

Phone : +6221 2938 5758 Phone : +6221 2938 5758

Email : [email protected] Email : [email protected]