Page 6 - Newsletter (Increase of Tobacco Product Excise Rate & Re-stipulation of Sales Taxes on Luxury Goods for Motor Vehicles)

P. 6

DDTC Newsletter Vol.02 | No.08 I November 2019 Page 6 of 7

Increase of Tobacco Product Excise Rate & Re-stipulation of

Sales Taxes on Luxury Goods for Motor Vehicles

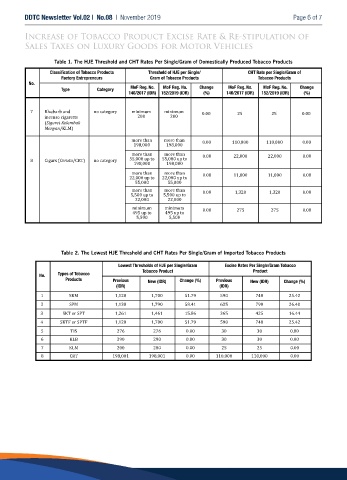

Table 1. The HJE Threshold and CHT Rates Per Single/Gram of Domestically Produced Tobacco Products

Classification of Tobacco Products Threshold of HJE per Single/ CHT Rate per Single/Gram of

Factory Entrepreneurs Gram of Tobacco Products Tobacco Products

No.

Type Category MoF Reg. No. MoF Reg. No. Change MoF Reg. No. MoF Reg. No. Change

146/2017 (IDR) 152/2019 (IDR) (%) 146/2017 (IDR) 152/2019 (IDR) (%)

7 Rhubarb and no category minimum minimum 0.00 25 25 0.00

incense cigarette 200 200

(Sigaret Kelembak

Menyan/KLM)

more than more than 0.00 110,000 110,000 0.00

198,000 198,000

more than more than 0.00 22,000 22,000 0.00

55,000 up to 55,000 up to

8 Cigars (Cerutu/CRT) no category

198,000 198,000

more than more than

0.00 11,000 11,000 0.00

22,000 up to 22,000 up to

55,000 55,000

more than more than

0.00 1,320 1,320 0.00

5,500 up to 5,500 up to

22,000 22,000

minimum minimum 0.00 275 275 0.00

495 up to 495 up to

5,500 5,500

Table 2. The Lowest HJE Threshold and CHT Rates Per Single/Gram of Imported Tobacco Products

Lowest Thresholds of HJE per Single/Gram Excise Rates Per Single/Gram Tobacco

Tobacco Product Product

No. Types of Tobacco

Products Previous New (IDR) Change (%) Previous New (IDR) Change (%)

(IDR) (IDR)

1 SKM 1,120 1,700 51.79 590 740 25.42

2 SPM 1,130 1,790 58.41 625 790 26.40

3 SKT or SPT 1,261 1,461 15.86 365 425 16.44

4 SKTF or SPTF 1,120 1,700 51.79 590 740 25.42

5 TIS 276 276 0.00 30 30 0.00

6 KLB 290 290 0.00 30 30 0.00

7 KLM 200 200 0.00 25 25 0.00

8 CRT 198,001 198,001 0.00 110,000 110,000 0.00