Page 2 - Newsletter (Update on New Tax Holiday Regime in Indonesia)

P. 2

DDTC Tax Newsletter 03 I Apr 2018 Page 2 of 5

UPDATE ON NEW TAX HOLIDAY REGIME IN INDONESIA

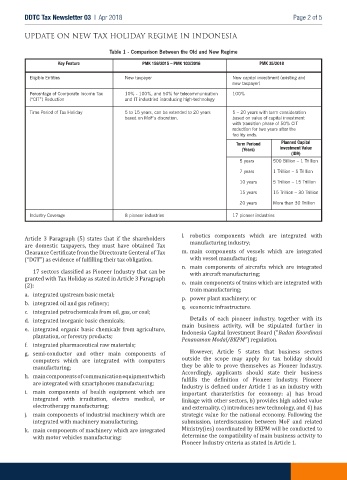

Table 1 - Comparison Between the Old and New Regime

Key Feature PMK 159/2015 – PMK 103/2016 PMK 35/2018

Eligible Entities New taxpayer New capital investment (existing and

new taxpayer)

Percentage of Coorporate Income Tax 10% - 100%, and 50% for telecommunication 100%

(“CIT”) Reduction and IT industried introducing high-technology

Time Period of Tax Holiday 5 to 15 years, can be extended to 20 years 5 – 20 years with term consideration

based on MoF’s discretion. based on value of capital investment

with transition phase of 50% CIT

reduction for two years after the

facility ends.

Term Periond Planned Capital

(Years) Investment Value

(IDR)

5 years 500 Billion – 1 Trillion

7 years 1 Trillion – 5 Trillion

10 years 5 Trillion – 15 Trillion

15 years 15 Trillion – 30 Trillion

20 years More than 30 Trillion

Industry Coverage 8 pioneer industries 17 pioneer industries

l. robotics components which are integrated with

Article 3 Paragraph (5) states that if the shareholders

manufacturing industry;

are domestic taxpayers, they must have obtained Tax

Clearance Certificate from the Directorate Genteral of Tax m. main components of vessels which are integrated

(“DGT”) as evidence of fulfilling their tax obligation. with vessel manufacturing;

n. main components of aircrafts which are integrated

17 sectors classified as Pioneer Industry that can be

with aircraft manufacturing;

granted with Tax Holiday as stated in Article 3 Paragraph

o. main components of trains which are integrated with

(2):

train manufacturing;

a. integrated upstream basic metal;

p. power plant machinery; or

b. integrated oil and gas refinery;

q. economic infrastructure.

c. integrated petrochemicals from oil, gas, or coal;

Details of each pioneer industry, together with its

d. integrated inorganic basic chemicals;

main business activity, will be stipulated further in

e. integrated organic basic chemicals from agriculture, Indonesia Capital Investment Board ("Badan Koordinasi

plantation, or forestry products;

Penanaman Modal/BKPM") regulation.

f. integrated pharmaceutical raw materials;

However, Article 5 states that business sectors

g. semi-conductor and other main components of

outside the scope may apply for tax holiday should

computers which are integrated with computers

they be able to prove themselves as Pioneer Industry.

manufacturing;

Accordingly, applicants should state their business

h. main components of communication equipment which

fulfills the definition of Pioneer Industry. Pioneer

are integrated with smartphones manufacturing;

Industry is defined under Article 1 as an industry with

i. main components of health equipment which are

important charateristics for economy: a) has broad

integrated with irradiation, electro medical, or

linkage with other sectors, b) provides high added value

electrotherapy manufacturing;

and externality, c) introduces new technology, and 4) has

j. main components of industrial machinery which are strategic value for the national economy. Following the

integrated with machinery manufacturing; submission, interdiscussion between MoF and related

k. main components of machinery which are integrated Ministry(ies) coordinated by BKPM will be conducted to

with motor vehicles manufacturing; determine the compatibility of main business activity to

Pioneer Industry criteria as stated in Article 1.