Page 3 - Newsletter (Update on New Tax Holiday Regime in Indonesia)

P. 3

DDTC Tax Newsletter 03 I Apr 2018 Page 3 of 5

UPDATE ON NEW TAX HOLIDAY REGIME IN INDONESIA

Timeline of Tax Holiday Application b. For business with existing capital investment whose

Based on PMK 35/2018 issuance of principle permit (izin prinsip), investment

permit (izin investasi), or capital investment

Application period for the application can be registration (pendaftaran penanaman modal) was

categorized into two categories as follows: conducted after the effective date of PMK 159/2015,

the application period refers to Article 16 Paragraph

a. For new capital investment, application period refers (4). Deadline of the application is one year after the

to Article 4 Paragraph (1). Deadline for application is issuance of PMK 35/2018.

within a period of five years after the effective date

of the regulation. Application for Tax Holiday should

be made prior to the of start commercial production,

either together with the application for new capital

investment or at a maximum within a year after the

issue of investment approval.

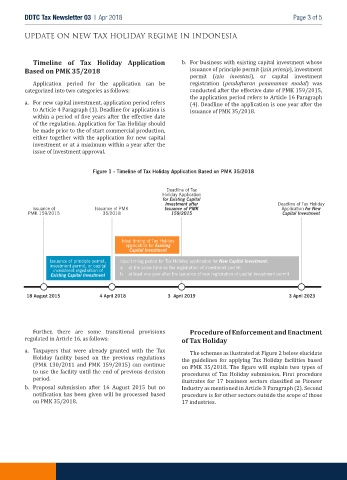

Figure 1 - Timeline of Tax Holiday Application Based on PMK 35/2018

Deadline of Tax

Holiday Application

for Existing Capital

Investment after Deadline of Tax Holiday

Issuance of Issuance of PMK Issuance of PMK Application for New

PMK 159/2015 35/2018 159/2015 Capital Investment

Ideal timing of Tax Holiday

application for Existing

Capital Investment

Issuance of principle permit, Ideal timing period for Tax Holiday application for New Capital Investment:

investment permit, or capital a. at the same time as the registration of investment permit

investment registration of

Existing Capital Investment b. at least one year after the issuance of new registration of capital investment permit

18 August 2015 4 April 2018 3 April 2019 3 April 2023

Procedure of Enforcement and Enactment

Further, there are some transitional provisions

of Tax Holiday

regulated in Article 16, as follows:

a. Taxpayers that were already granted with the Tax

The schemes as ilustrated at Figure 2 below elucidate

Holiday facility based on the previous regulations

the guidelines for applying Tax Holiday facilities based

(PMK 130/2011 and PMK 159/2015) can continue

on PMK 35/2018. The figure will explain two types of

to use the facility until the end of previous decision

procedures of Tax Holiday submission. First procedure

period.

ilustrates for 17 business sectors classified as Pioneer

b. Proposal submission after 16 August 2015 but no Industry as mentioned in Article 3 Paragraph (2). Second

notification has been given will be processed based procedure is for other sectors outside the scope of those

on PMK 35/2018. 17 industries.