Page 6 - Newsletter (Tax Incentives for Transportation Sector, Sanction for Customs, and Target of Extensification)

P. 6

DDTC Newsletter Vol.02 | No.01 I July 2019 Page 6 of 6

TAX INCENTIVES FOR TRANSPORTATION SECTOR, SANCTION FOR CUSTOMS,

AND TARGET OF EXTENSIFICATION

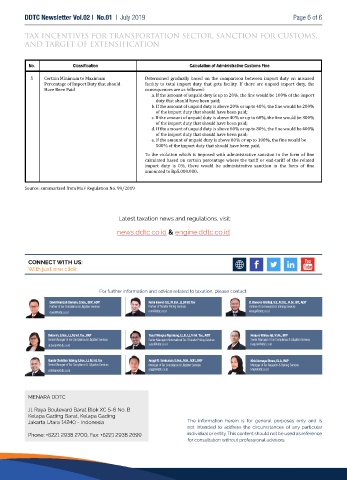

No. Classification Calculation of Administrative Customs Fine

5 Certain Minimum to Maximum Determined gradually based on the comparison between import duty on misused

Percentage of Import Duty that should facility to total import duty that gets facility. If there are unpaid import duty, the

Have Been Paid consequences are as followed:

a. If the amount of unpaid duty is up to 20%, the fine would be 100% of the import

duty that should have been paid;

b. If the amount of unpaid duty is above 20% or up to 40%, the fine would be 200%

of the import duty that should have been paid;

c. If the amount of unpaid duty is above 40% or up to 60%, the fine would be 300%

of the import duty that should have been paid;

d. If the amount of unpaid duty is above 60% or up to 80%, the fine would be 400%

of the import duty that should have been paid;

e. If the amount of unpaid duty is above 80% or up to 100%, the fine would be

500% of the import duty that should have been paid;

To the violation which is imposed with administrative sanction in the form of fine

calculated based on certain percentage where the tariff or end-tariff of the related

import duty is 0%, there would be administrative sanction in the form of fine

amounted to Rp5.000.000.

Source: summarized from MoF Regulation No. 99/2019

Latest taxation news and regulations, visit:

news.ddtc.co.id & engine.ddtc.co.id

CONNECT WITH US:

With just one click

For further information and advice related to taxation, please contact:

David Hamzah Damian, S.Sos., BKP., ADIT Romi Irawan S.E., M.B.A., LL.M Int. Tax B. Bawono Kristiaji, S.E., M.S.E., M.Sc. IBT., ADIT

Partner of Tax Compliance & Litigation Services Partner of Transfer Pricing Services Partner of Tax Research & Training Services

[email protected] [email protected] [email protected]

Deborah, S.Sos., LL.M. Int. Tax., BKP Yusuf Wangko Ngantung, LL.B., LL.M Int. Tax., ADIT Herjuno Wahyu Aji, M.Ak., BKP

Senior Manager of Tax Compliance & Litigation Services Senior Manager of International Tax / Transfer Pricing Services Senior Manager of Tax Compliance & Litigation Services

[email protected] [email protected] [email protected]

Ganda Christian Tobing, S.Sos., LL.M. Int. Tax Anggi P.I. Tambunan, S.Sos., M.H., ADIT., BKP Khisi Armaya Dhora, S.I.A., BKP

Senior Manager of Tax Compliance & Litigation Services Manager of Tax Compliance & Litigation Services Manager of Tax Research & Training Services

[email protected] [email protected] [email protected]

MENARA DDTC

Jl. Raya Boulevard Barat Blok XC 5-6 No. B

Kelapa Gading Barat, Kelapa Gading

Jakarta Utara 14240 - Indonesia The information herein is for general purposes only and is

not intended to address the circumstances of any particular

Phone: +6221 2938 2700, Fax: +6221 2938 2699 individual or entity. This content should not be used as reference

for consultation without professional advisors.