Page 6 - Newsletter (Reduction of Income Tax Rates for Publicly Listed Companies and Establishment of VAT Withholder Criteria for E-Commerce Businesses)

P. 6

DDTC Newsletter Vol.04 | No.01 I July 2020 Page 6 of 13

Reduction of Income Tax Rates for Publicly Listed Companies and

Establishment of VAT Withholder Criteria for E-Commerce Businesses

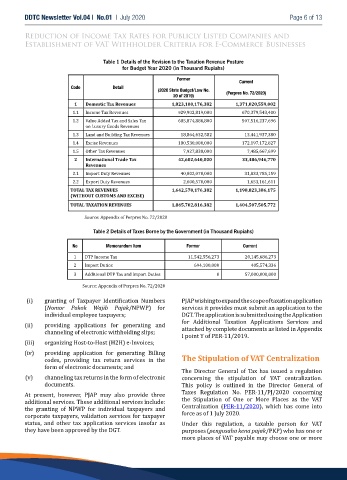

Table 1 Details of the Revision to the Taxation Revenue Posture

for Budget Year 2020 (in Thousand Rupiahs)

Former

Current

Code Detail

(2020 State Budget/Law No. (Perpres No. 72/2020)

20 of 2019)

1 Domestic Tax Revenues 1,823,100,176,382 1,371,020,559,002

1.1 Income Tax Revenues 929,902,819,000 670,379,543,400

1.2 Value Added Tax and Sales Tax 685,874,886,800 507,516,237,696

on Luxury Goods Revenues

1.3 Land and Building Tax Revenues 18,864,632,582 13,441,937,380

1.4 Excise Revenues 180,530,000,000 172,197,172,827

1.5 Other Tax Revenues 7,927,838,000 7,485,667,699

2 International Trade Tax 42,602,640,000 33,486,946,770

Revenues

2.1 Import Duty Revenues 40,002,070,000 31,833,785,159

2.2 Export Duty Revenues 2,600,570,000 1,653,161,611

TOTAL TAX REVENUES 1,642,570,176,382 1,198,823,386,175

(WITHOUT CUSTOMS AND EXCISE)

TOTAL TAXATION REVENUES 1,865,702,816,382 1,404,507,505,772

Source: Appendix of Perpres No. 72/2020

Table 2 Details of Taxes Borne by the Government (in Thousand Rupiahs)

No Memorandum Item Former Current

1 DTP Income Tax 11,542,556,273 20,145,686,273

2 Import Duties 694,100,000 405,574,336

3 Additional DTP Tax and Import Duties 0 57,000,000,000

Source: Appendix of Perpres No. 72/2020

(i) granting of Taxpayer Identification Numbers PJAP wishing to expand the scope of taxation application

(Nomor Pokok Wajib Pajak/NPWP) for services it provides must submit an application to the

individual employee taxpayers; DGT. The application is submitted using the Application

for Additional Taxation Applications Services and

(ii) providing applications for generating and

attached by complete documents as listed in Appendix

channeling of electronic withholding slips;

I point Y of PER-11/2019.

(iii) organizing Host-to-Host (H2H) e-Invoices;

(iv) providing application for generating Billing The Stipulation of VAT Centralization

codes, providing tax return services in the

form of electronic documents; and

The Director General of Tax has issued a regulation

(v) channeling tax returns in the form of electronic concerning the stipulation of VAT centralization.

documents. This policy is outlined in the Director General of

Taxes Regulation No. PER-11/PJ/2020 concerning

At present, however, PJAP may also provide three

the Stipulation of One or More Places as the VAT

additional services. These additional services include:

Centralization (PER-11/2020), which has come into

the granting of NPWP for individual taxpayers and

force as of 1 July 2020.

corporate taxpayers, validation services for taxpayer

status, and other tax application services insofar as Under this regulation, a taxable person for VAT

they have been approved by the DGT. purposes (pengusaha kena pajak/PKP) who has one or

more places of VAT payable may choose one or more