Page 7 - Working Paper (The Myths and Realities of Tax Performance Under Semi-Autonomous Revenue Authorities)

P. 7

DDTC Working Paper 0213

7

lower contribution of income taxes (see Table 1). and pay taxes, where the taxpayer in the country

Moreover, this condition can be interpreted as adopting the model of SARA apparently spent more

limited institutional capacity in collecting taxes. time (367.5 hours) than in countries that adopt a

Tax agencies tend to focus on type of tax that is model of non-SARA (289.2 hours). Both indicators

easier to apply (i.e. sales tax and international show that the SARA model is not always associated

trade). with effectiveness and efficiency of the tax system.

The high intensity of meetings with tax officials

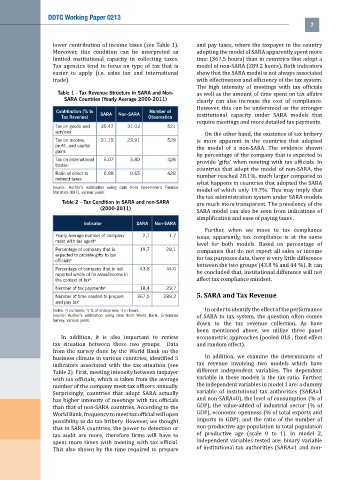

Table 1 - Tax Revenue Structure in SARA and Non- as well as the amount of time spent on tax affairs

SARA Countries (Yearly Average 2000-2011) clearly can also increase the cost of compliance.

However, this can be understood as the stronger

Contribution (% to Number of

Tax Revenue) SARA Non-SARA Observation institutional capacity under SARA models that

require meetings and more detailed tax payments.

Tax on goods and 30.47 31.03 521

services

On the other hand, the existence of tax bribery

Tax on income, 31.15 23.91 529 is more apparent in the countries that adopted

profit, and capital

gains the model of a non-SARA. The evidence shown

by percentage of the company that is expected to

Tax on international 5.07 5.80 428

trades provide ‘gifts’ when meeting with tax officials. In

countries that adopt the model of non-SARA, the

Ratio of direct to 0.88 0.65 428

indirect taxes number reached 28.1%, much larger compared to

what happens in countries that adopted the SARA

Source: Author’s estimation using data from Government Finance

Statistics (IMF), various years. model of which only 19.7%. This may imply that

the tax administration system under SARA models

Table 2 - Tax Condition in SARA and non-SARA

(2000-2011) are much more transparent. The prevalency of the

SARA model can also be seen from indications of

simplification and ease of paying taxes .

Indicator SARA Non-SARA

Further, when we move to tax compliance

Yearly average number of company 2,7 1,7 issue, apparently, tax compliance is at the same

meet with tax agent a

level for both models. Based on percentage of

Percentage of company that is 19,7 28,1 companies that do not report all sales or income

expected to provide gifts to tax

officials b for tax purposes data, there is very little difference

between the two groups (43.8 % and 44 %). It can

Percentage of company that is not 43,8 44,0

reported whole of its sales/income in be concluded that, institutional difference will not

the context of tax b affect tax compliance mindset.

Number of tax payments a 18,4 29,7

Number of time needed to prepare 367,5 289,2 5. SARA and Tax Revenue

and pay tax c

Notes: ) numbers; ) % of enterprises; ) in hours. In order to identify the effect of the performance

a

b

c

Source: Author’s estimation using data from World Bank, Enterprise of SARA to tax system, the question often comes

Survey, various years.

down to the tax revenue collection. As have

been mentioned above, we utilize three panel

In addition, it is also important to review econometric approaches (pooled OLS , fixed effect

tax situation between these two groups. Data and random effect).

from the survey done by the World Bank on the

In addition, we examine the determinants of

business climate in various countries, identified 5

tax revenue involving two models which have

indicators associated with the tax situation (see

different independent variables. The dependent

Table 2). First, meeting intensity between taxpayer

variable in these models is the tax ratio. Further,

with tax officials, which is taken from the average

the independent variables in model 1 are: a dummy

number of the company meet tax officers annually.

variable of institutional tax authorities (SARA=1

Surprisingly, countries that adopt SARA actually

and non-SARA=0), the level of consumption (% of

has higher intensity of meetings with tax officials

GDP), the value-added of industrial sector (% of

than that of non-SARA countries. According to the

GDP), economic openness (% of total exports and

World Bank, frequency to meet tax official will open

imports to GDP), and the ratio of the number of

possibility to do tax bribery. However, we thought

non-productive age population to total population

that in SARA countries, the power to detection or

of productive age (scale 0 to 1). In model 2,

tax audit are more, therefore firms will have to

independent variables tested are: binary variable

spent more times with meeting with tax official.

of institutional tax authorities (SARA=1 and non-

This also shown by the time required to prepare