Page 11 - Working Paper (Fiscal Decentralization and Sub-national Taxes: Specific Case of Indonesia)

P. 11

DDTC Working Paper 1015

11

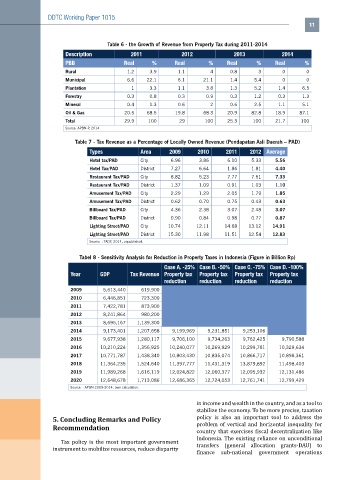

Table 6 - the Growth of Revenue from Property Tax during 2011-2014

Description 2011 2012 2013 2014

PBB Real % Real % Real % Real %

Rural 1.2 3.9 1.1 4 0.8 3 0 0

Municipal 6.6 22.1 6.1 21.1 1.4 5.4 0 0

Plantation 1 3.3 1.1 3.8 1.3 5.2 1.4 6.5

Forestry 0.3 0.8 0.3 0.9 0.3 1.2 0.3 1.3

Mineral 0.4 1.3 0.6 2 0.6 2.5 1.1 5.1

Oil & Gas 20.5 68.5 19.8 68.3 20.9 82.8 18.9 87.1

Total 29.9 100 29 100 25.3 100 21.7 100

Source: APBN-P, 2014

Table 7 - Tax Revenue as a Percentage of Locally Owned Revenue (Pendapatan Asli Daerah – PAD)

Types Area 2009 2010 2011 2012 Average

Hotel tax/PAD City 6.96 3.86 6.10 5.33 5.56

Hotel Tax/PAD District 7.27 6.64 1.86 1.81 4.40

Restaurant Tax/PAD City 8.82 5.23 7.77 7.51 7.33

Restaurant Tax/PAD District 1.37 1.09 0.91 1.03 1.10

Amusement Tax/PAD City 2.29 1.29 2.05 1.79 1.85

Amusement Tax/PAD District 0.62 0.70 0.75 0.43 0.63

Billboard Tax/PAD City 4.36 2.38 3.07 2.48 3.07

Billboard Tax/PAD District 0.90 0.84 0.98 0.77 0.87

Lighting Street/PAD City 10.74 12.11 14.68 13.12 14.91

Lighting Street/PAD District 15.30 11.98 11.51 12.54 12.83

Source: : TADF, 2014, unpublished.

Tabel 8 - Sensitivity Analysis for Reduction in Property Taxes in Indonesia (Figure in Billion Rp)

Case A. -25% Case B. -50% Case C. -75% Case D. -100%

Year GDP Tax Revenue Property tax Property tax Property tax Property tax

reduction reduction reduction reduction

2009 5,613,440 619,900

2010 6,446,851 723,300

2011 7,422,781 873,900

2012 8,241,864 980,200

2013 8,695,167 1,139,300

2014 9,173,401 1,207,658 9,199,969 9,231,851 9,253,106

2015 9,677,938 1,280,117 9,706,100 9,734,263 9,762,425 9,790,588

2016 10,210,224 1,356,925 10,240,077 10,269,929 10,299,781 10,329,634

2017 10,771,787 1,438,340 10,803,430 10,835,074 10,866,717 10,898,361

2018 11,364,235 1,524,640 11,397,777 11,431,319 13,879,892 11,498,403

2019 11,989,268 1,616,119 12,024,822 12,060,377 12,095,932 12,131,486

2020 12,648,678 1,713,086 12,686,365 12,724,053 12,761,741 12,799,429

Source: : APBN 2009-2014, own calculation.

in income and wealth in the country, and as a tool to

stabilize the economy. To be more precise, taxation

5. Concluding Remarks and Policy policy is also an important tool to address the

Recommendation problem of vertical and horizontal inequality for

country that exercises fiscal decentralization like

Indonesia. The existing reliance on unconditional

Tax policy is the most important government

transfers (general allocation grants-DAU) to

instrument to mobilize resources, reduce disparity

finance sub-national government operations