Page 9 - Working Paper (Fiscal Decentralization and Sub-national Taxes: Specific Case of Indonesia)

P. 9

DDTC Working Paper 1015

9

Table 5 - Revenue Sharing based on Law 33 of 2004 (in percentage)

Revenue-shared Sourced Central Gov Prov Originating LGs Other LGs in the same Prov All LGs

Personal Income Tax 80 8 12 - -

Property Tax 9 a 16.2 64.8 - 10 b

Land & Building Transfer fee - 16 64 - 20

Forestry: land-rent 20 16 64 - -

Forestry: resource rent 20 16 32 32 -

Forestry: reforestation 60 - 40 c - -

Mining: land-rent 20 16 64 - -

Mining: Royalty 20 16 32 32 -

Fishery 20 - - - 80

3 6 6

Oil 84.5

0.1 d 0.2 d 0.2 d

6 12 12

Gas 69.5

0.1 d 0.2 d 0.2 d

Geothermal 20 16 32 32

Notes: a ) 9 percent of the revenue collected from property tax is defined as administration costs and distributed equally to all local government; b ) 10 percent of the revenue collected

from property tax is allocated to all local governments based on the actual property tax revenue collection at the current year. 6.5 percent is distributed to all governments, and 3.5

percent is given as incentive to all local governments, which have revenues exceed the target of collection from the previous year. Currently, Central Government has relinquished all

property tax receipt for household to local governments; c ) Revenue Sharing from reforestation is an ear-marked grant to rehabilitate forests in originating local governments; d ) 0.5

percent of the revenue sharing from oil and gas is allocated to Provinces and vertically below local governments as additional fund for education (ear-marked grant).

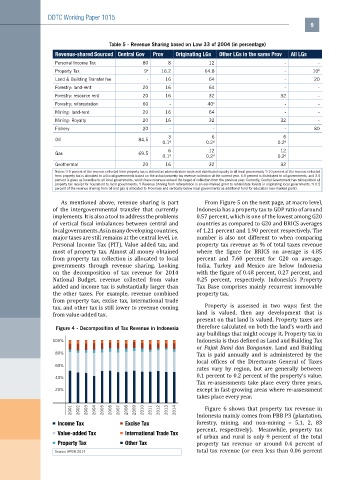

As mentioned above, revenue sharing is part From Figure 5 on the next page, at macro level,

of the intergovernmental transfer that currently Indonesia has a property tax to GDP ratio of around

implements. It is also a tool to address the problems 0.57 percent, which is one of the lowest among G20

of vertical fiscal imbalances between central and countries as compared to G20 and BRICS averages

local governments. As in many developing countries, of 1.21 percent and 1.90 percent respectively. The

major taxes are still remains at the central level, i.e. number is also not different to when comparing

Personal Income Tax (PIT), Value added tax, and property tax revenue as % of total taxes revenue

most of property tax. Almost all money obtained where the figure for BRICS on average is 4.85

from property tax collection is allocated to local percent and 7.60 percent for G20 on average.

governments through revenue sharing. Looking India, Turkey and Mexico are below Indonesia

on the decomposition of tax revenue for 2014 with the figure of 0.48 percent, 0.27 percent, and

National Budget, revenue collected from value 0.25 percent, respectively. Indonesia’s Property

added and income tax is substantially larger than Tax Base comprises mainly recurrent immovable

the other taxes. For example, revenue combined property tax.

from property tax, excise tax, international trade

Property is assessed in two ways: first the

tax, and other tax is still lower to revenue coming

land is valued, then any development that is

from value-added tax.

present on that land is valued. Property taxes are

Figure 4 - Decomposition of Tax Revenue in Indonesia therefore calculated on both the land’s worth and

any buildings that might occupy it. Property tax in

100% Indonesia is thus defined as Land and Building Tax

or Pajak Bumi dan Bangunan. Land and Building

80%

Tax is paid annually and is administered by the

local offices of the Directorate General of Taxes

60%

rates vary by region, but are generally between

40% 0.1 percent to 0.2 percent of the property’s value.

Tax re-assessments take place every three years,

20% except in fast-growing areas where re-assessment

takes place every year.

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Figure 6 shows that property tax revenue in

Indonesia mainly comes from PBB P3 (plantation,

Income Tax Excise Tax forestry, mining, and non-mining – 5,1, 2, 83

Value-added Tax International Trade Tax percent, respectively). Meanwhile, property tax

of urban and rural is only 9 percent of the total

Property Tax Other Tax property tax revenue or around 0.4 percent of

Source: APBN 2014 total tax revenue (or even less than 0.06 percent