Page 8 - Working Paper (Analysis of Political Budget Cycles in Emerging South East Asian Economies)

P. 8

DDTC Working Paper 0414 DDTC Working Paper 0414

8

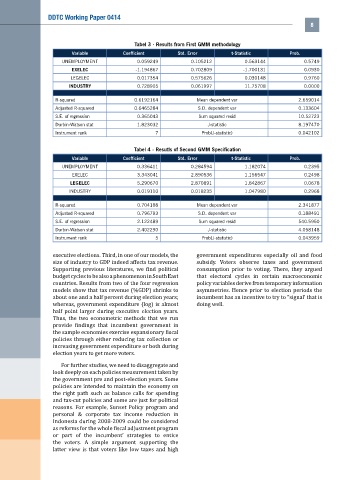

Tabel 3 - Results from First GMM methodology

Variable Coefficient Std. Error t-Statistic Prob.

UNEMPLOYMENT 0.059249 0.105212 0.563144 0.5749

EXELEC -1.194867 0.702809 -1.700131 0.0930

LEGELEC 0.017354 0.575626 0.030148 0.9760

INDUSTRY 0.728905 0.061997 11.75708 0.0000

R-squared 0.6192164 Mean dependent var 2.659014

Adjusted R-squared 0.6465284 S.D. dependent var 0.133604

S.E. of regression 0.365043 Sum squared resid 10.52723

Durbin-Watson stat 1.823032 J-statistic 8.197470

Instrument rank 7 Prob(J-statistic) 0.042102

Tabel 4 - Resutls of Second GMM Specification

Variable Coefficient Std. Error t-Statistic Prob.

UNEMPLOYMENT 0.336411 0.284594 1.182074 0.2395

EXELEC 3.343041 2.890536 1.156547 0.2498

LEGELEC 5.290670 2.870891 1.842867 0.0678

INDUSTRY 0.019110 0.018235 1.047980 0.2968

R-squared 0.704188 Mean dependent var 2.341877

Adjusted R-squared 0.796793 S.D. dependent var 0.188491

S.E. of regression 2.122489 Sum squared resid 540.5950

Durbin-Watson stat 2.402290 J-statistic 4.058148

Instrument rank 5 Prob(J-statistic) 0.043959

executive elections. Third, in one of our models, the government expenditures especially oil and food

size of industry to GDP indeed affects tax revenue. subsidy. Voters observe taxes and government

Supporting previous literatures, we find political consumption prior to voting. There, they argued

budget cycles to be also a phenomenon in South East that electoral cycles in certain macroeconomic

countries. Results from two of the four regression policy variables derive from temporary information

models show that tax revenue (%GDP) shrinks to asymmetries. Hence prior to election periods the

about one and a half percent during election years; incumbent has an incentive to try to “signal’ that is

whereas, government expenditure (log) is almost doing well.

half point larger during executive election years.

Thus, the two econometric methods that we run

provide findings that incumbent government in

the sample economies exercise expansionary fiscal

policies through either reducing tax collection or

increasing government expenditure or both during

election years to get more voters.

For further studies, we need to disaggregate and

look deeply on each policies measurement taken by

the government pre and post-election years. Some

policies are intended to maintain the economy on

the right path such as balance calls for spending

and tax-cut policies and some are just for political

reasons. For example, Sunset Policy program and

personal & corporate tax income reduction in

Indonesia during 2008-2009 could be considered

as reforms for the whole fiscal adjustment program

or part of the incumbent’ strategies to entice

the voters. A simple argument supporting the

latter view is that voters like low taxes and high